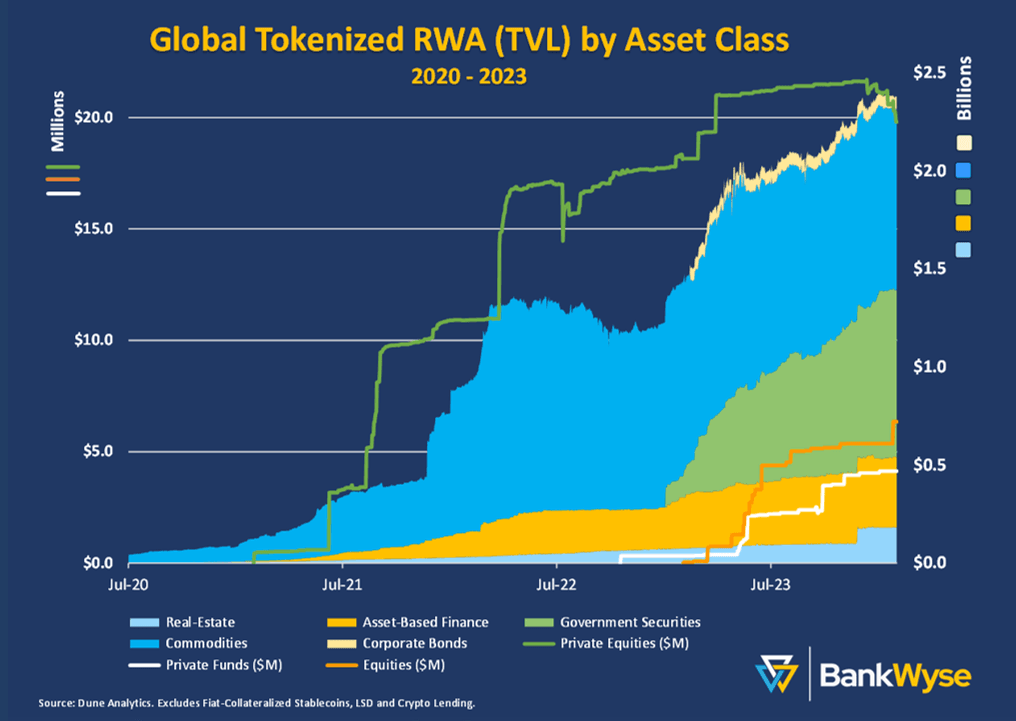

What fueled Tokenized RWA growth to double market cap in 2023 when commodities, which accounted for more than 75% of the category going into the year, grew just 2%? There’s been much discussion about the surge in tokenized government securities, which grew 750%, but what else happened and why? I was curious and thought I would dig into it a bit and share what I found.

➖Commodities were > 75% of the category going into the year but grew just 2%.

🧨Real Estate, Asset-Based Finance, and Government Securities contributed over 91% of category growth, with 250%, 170%, and 750% increases in TVL each, respectively.

🔥Other accelerants came from Public and Private Equities and Private funds, which collectively grew nearly 170%.

Growth Driven by Strong Demand from Investors

A survey by Celent and BNY Mellon found that 91% of Institutional Investors are interested in tokenized assets, and 97% believe tokenization will fundamentally change the world of wealth management. Another by E&Y Parthenon reports that 74% of HNWI plan to invest in tokenized asset alternatives by the end of this year. Further, they found that nearly

∼Half of all investors favor Real Estate tokenization.

∼ 60% say Private Equity is their primary asset class of interest.

Tokenization = Asset Fractionalization = Lower Minimums, New Opportunities

Tokenization is particularly appealing to HNWI because it enables their access to alternative investments, previously unavailable due to high minimums or long investment horizons. Bain & Company and JP Morgan recently reported investors want this access to

👍improve diversification (60%) 🫰produce higher returns (25%)

And This is Just the Tip of the Iceberg of Potential

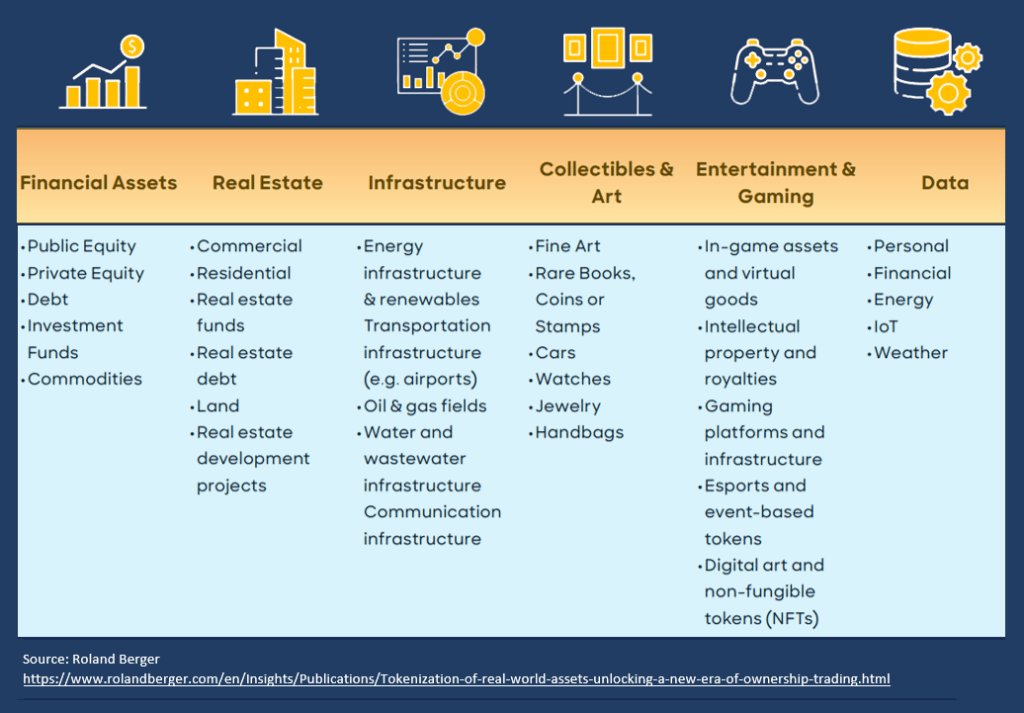

Imagine all the liquidity that traditionally illiquid assets could generate if asset ownership can be fractionalized; agreements are immutable, audible, and enforceable; and payments are frictionless, instant, and free to cross-borders. Here, Roland Berger illustrates the limitless possibilities beyond traditional financial assets.

We’ve merely begun to scratch the surface!

Blockchain technology and tokenization solve the fragmented, non-standardized, duplicative, and inefficient problems financial processes have today by creating a shared, transparent, immutable, and atomic data record for a seamless, integrated exchange of verifiable information.

Blockchain and RWA Tokenization Will Revolutionize the Way We Exchange Value Worldwide!

Justin Culver

Co-Founder, CTO, Board Member BankWyse

Justin@BankWyse.com